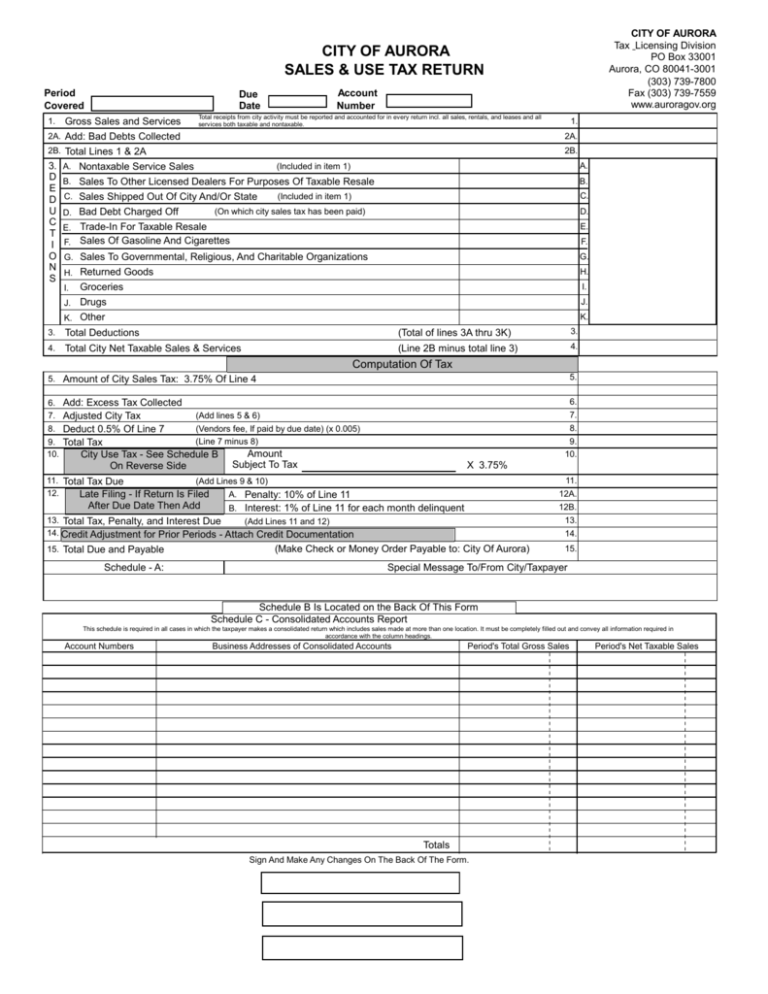

aurora sales tax rate

What is the sales tax rate in Aurora Colorado. 44 E Downer Place Aurora IL 60505.

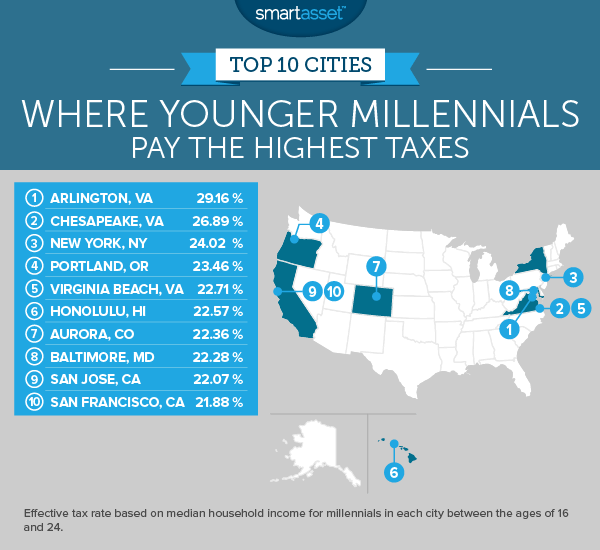

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

The minimum combined 2022 sales tax rate for Aurora Minnesota is.

. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. Aurora is in the following zip codes. For tax rates in other cities see Illinois sales taxes by city and county.

80010 80011 80012. Aurora is in the following zip codes. Wayfair Inc affect New York.

The County sales tax rate is 05. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates.

Sales Tax Breakdown Aurora Details Aurora OH is in Portage County. 4 Sales tax on food liquor for immediate consumption. The minimum combined 2022 sales tax rate for Aurora Colorado is.

The December 2020 total local sales tax rate was 7250. The december 2020 total local sales tax rate was also 8000. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

Wayfair Inc affect Minnesota. Did South Dakota v. For tax rates in other cities see Missouri sales taxes by city and county.

60502 60503 60504. The Aurora sales tax rate is. Method to calculate Arapahoe County sales tax.

The Aurora sales tax rate is. Sales Tax Breakdown Aurora Details Aurora MN is in Saint Louis County. Business Licensing and Tax Class.

Higher sales tax than 81 of Colorado localities 24 lower than the maximum sales tax in CO The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. The County sales tax rate is. Sales Tax Breakdown Aurora Details Aurora MO is in Lawrence County.

The December 2020 total local sales tax rate was also 8250. The minimum combined 2022 sales tax rate for Aurora Texas is 775. This is the total of state county and city sales tax rates.

Aurora MO Sales Tax Rate The current total local sales tax rate in Aurora MO is 8850. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

There is no applicable special tax. Wayfair Inc affect Texas. Sales Tax Breakdown Aurora Details Aurora OR is in Marion County.

Aurora is in the following zip codes. The New York sales tax rate is currently. The current total local sales tax rate in Aurora OH is 7000.

The current total local sales tax rate in Aurora IL is 8250. The Aurora sales tax rate is. The December 2020 total local sales tax rate was also 5500.

Did South Dakota v. Aurora is in the following zip codes. Sales Tax Breakdown Aurora Details Aurora NE is in Hamilton County.

Aurora is in the following zip codes. The current total local sales tax rate in Aurora NE is 5500. The County sales tax rate is.

The Minnesota sales tax rate is currently. The current total local sales tax rate in Aurora OR is 0000. What is the sales tax rate in Aurora New York.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. Sales Tax Breakdown Aurora Details Aurora IL is in Kane County. Did South Dakota v.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The December 2020 total local sales tax rate was also 8000. The County sales tax rate is.

Aurora SD Sales Tax Rate The current total local sales tax rate in Aurora SD is 5500. Sales Tax Breakdown Aurora Details Aurora CO is in Arapahoe County. The Texas sales tax rate is currently 625.

This is the total of state county and city sales tax rates. The current total local sales tax rate in Aurora IL is 8250. The Aurora sales tax rate is.

The Aurora sales tax rate is 1. Aurora is in the following zip codes. The Colorado sales tax rate is currently.

The December 2020 total local sales tax rate was also 7375. The City of Auroras tax rate is 8850 and is broken down as follows. You can print a 85 sales tax table here.

The December 2020 total local sales tax rate was also 0000. 275 lower than the maximum sales tax in IL. 0375 lower than the maximum sales tax in MO The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax.

What is the sales tax rate in Aurora Minnesota. 2 For tax rates in other cities see Colorado sales taxes by city and county. Sales Tax Breakdown Aurora Details Aurora SD is in Brookings County.

You can print a 825 sales tax table here. The County sales tax rate is. The minimum combined 2022 sales tax rate for Aurora New York is.

The current total local sales tax rate in Aurora MN is 7375. The December 2020 total local sales tax rate was also 5500. Aurora is in the following zip codes.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. 275 lower than the maximum sales tax in IL The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. There is no applicable county tax.

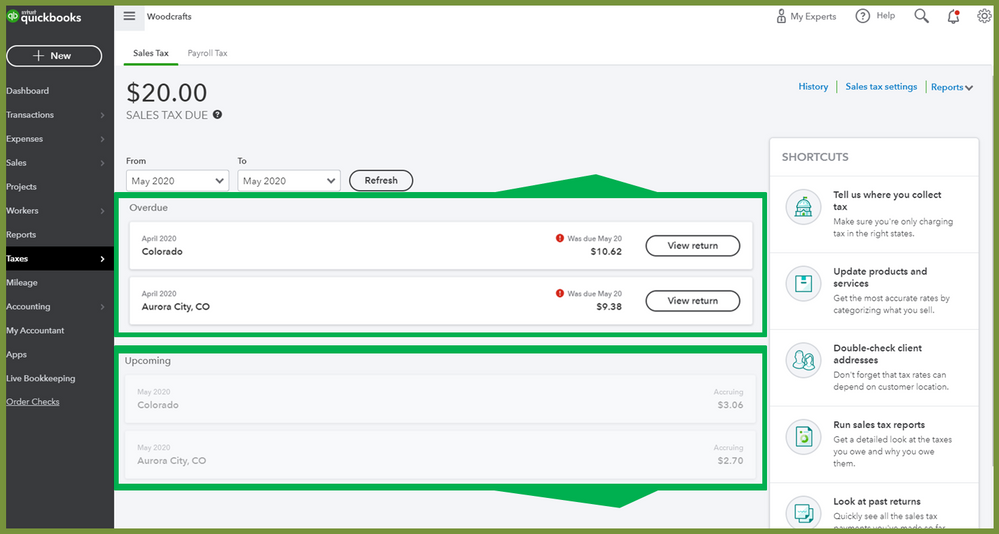

File Aurora Taxes Online Tax Reminders. The Colorado sales tax rate is currently. Aurora is in the following zip codes.

The December 2020 total local sales tax rate was 8350. Aurora Sales Tax Rates for 2022. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month.

Wayfair Inc affect Colorado. The current total local sales tax rate in Aurora CO is 8000. Did South Dakota v.

You can print a 9225 sales tax table here. This is the total of state county and city sales tax rates.

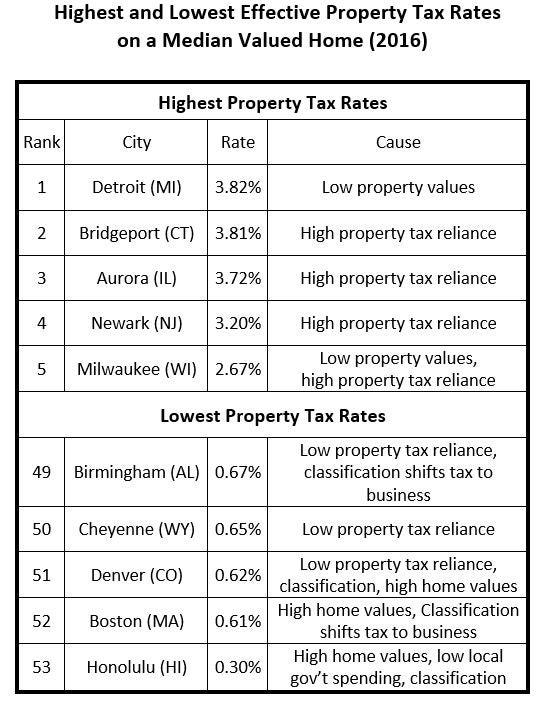

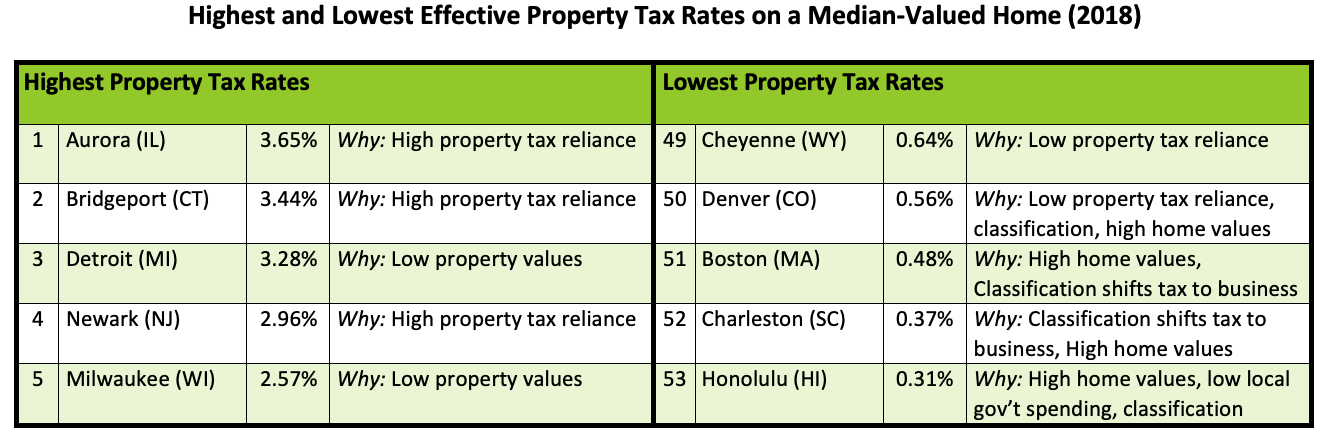

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Cannabis Canada Weekly Aurora Ceo On Focus On Medical Sales Illicit Products Full Of Contaminants Bnn Bloomberg

Aurora Cannabis Announces Fiscal 2021 Fourth Quarter Results

How Amazon Charges Sales Tax On Colorado Purchases The Denver Post

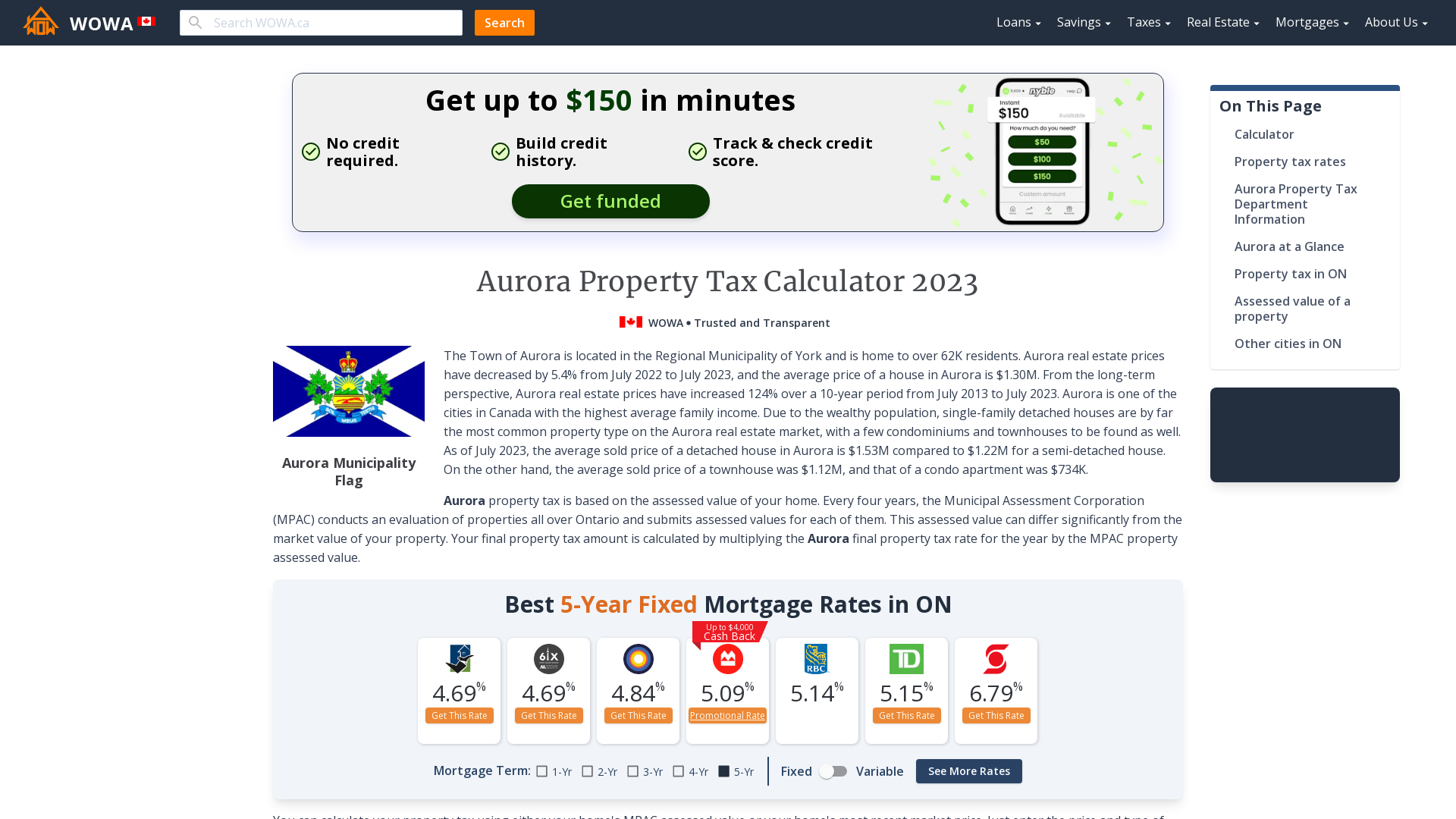

Aurora Property Tax 2021 Calculator Rates Wowa Ca

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

How Colorado Taxes Work Auto Dealers Dealr Tax

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Set Up Automated Sales Tax Center

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Property Tax Lincoln Institute Of Land Policy

Who Pays The Least Property Tax In Ontario The Answer May Surprise You Alex Irish Associates

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute